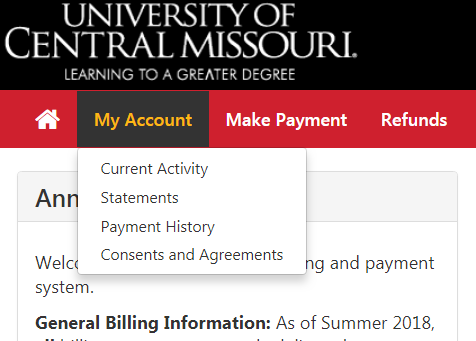

All billing statements are available electronically in the UCM Payment Center from the Student Home tab in MyCentral.

Meet Tony Lubbers

Director of Financial Aid

Tony has over 26 years of experience in higher education student financial aid. He has a comprehensive understanding of the important role that financial aid has on student persistence and retention to ensure that you remain on the path toward successfully earning your degree.

Meet Rhonda Stangel

Director of Student Accounts and Loans

Rhonda has 24 years of experience in higher education at UCM working with student accounts. Her goal is to provide assistance to you and your family to meet your tuition-related financial obligations in order to succeed with your college experience.

Are your ready for disbursement? Complete your financial aid requirements in advance so your aid will be authorized to pay towards your bill each semester.